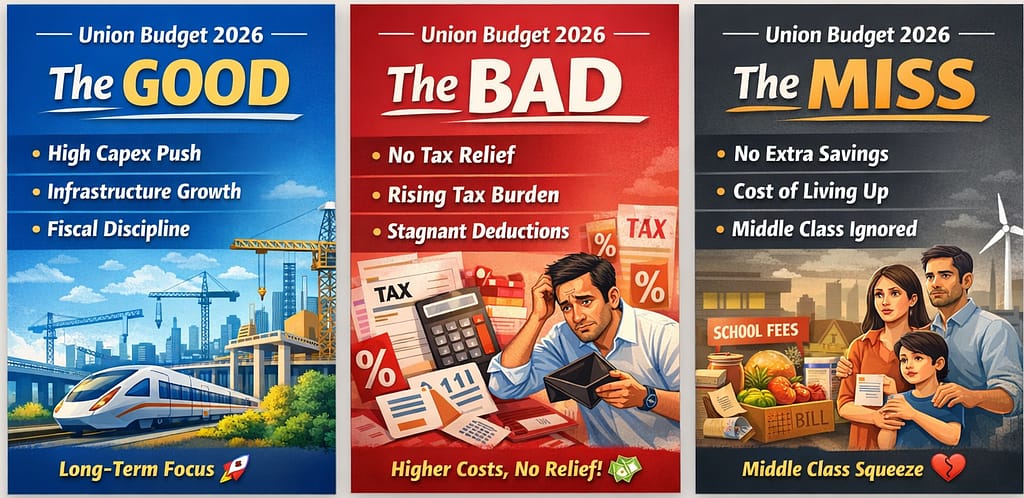

Union Budget 2026–27: The Good, The Bad, and the Middle Class Miss

On 1st February 2026, Finance Minister Nirmala Sitharaman presented the Union Budget 2026–27, describing it as a key pillar in building a “Viksit Bharat” (Developed India) by 2047.

The budget arrives at a sensitive global moment. World growth is slowing, geopolitical tensions remain elevated, and supply-chain disruptions continue to test emerging economies. India, however, stands out with growth projected above 6.5%. Against this backdrop, the government has chosen a clear path: prioritise long-term capital expenditure over short-term giveaways.

For industrialists and global investors, this is a reassuring roadmap. For the salaried middle class juggling EMIs, school fees, rent, and urban inflation, the silence on tax relief is hard to ignore.

At Vijay Foundations, we believe in cutting through noise and focusing on substance. This deep-dive explains how Union Budget 2026–27 affects your wealth, your business, and your household budget—and what you can practically do about it.

“For the Sensex, this budget is a green signal.

For the salaried middle class, it feels more like a red light at the end of the month.”

Quick Summary: Top Highlights

Union Budget 2026–27 is a high-capex, fiscally disciplined ‘builder’s budget’.

No major new income-tax relief for salaried taxpayers.

Middle-class households continue to face fiscal drag as slabs and deductions remain frozen.

Long-term opportunities emerge in infrastructure, manufacturing, defence, technology, and renewables.

Households must rely on financial planning, not tax cuts, for near-term relief.

1. The Macro View: Fiscal Discipline Meets Capex Aggression

The “Golden Mean” Strategy

The government has clearly opted for a builder’s budget—spend aggressively on infrastructure while keeping fiscal numbers under control. The core idea is straightforward: build national assets today so that jobs, incomes, and productivity follow over the next decade.

This supply-side growth approach has been a consistent policy direction over recent years and continues strongly in Budget 2026–27.

A. The Capex Juggernaut

The standout number is public capital expenditure of ₹12.2 lakh crore, around 3.1% of GDP—a multi-fold jump from roughly ₹2 lakh crore in 2014–15.

Key focus areas include:

Road transport: Faster execution under Bharatmala and new expressways to reduce logistics costs.

Railways: Dedicated Freight Corridors, logistics hubs, and high-speed rail corridors.

Power & green energy: Expansion of Green Energy Corridors and grid upgrades for renewable integration.

For companies in construction, capital goods, logistics, and power, this creates a strong multi-year demand pipeline.

B. Fiscal Prudence: The Silent Win

Despite the aggressive capex push, the fiscal deficit is targeted at 4.3% of GDP, lower than the revised 4.4% of the previous year. The government remains committed to a glide path aimed at bringing debt-to-GDP to the mid-50% range over the next decade.

Why this matters to households:

Lower government borrowing reduces upward pressure on interest rates over time.

A credible fiscal path keeps foreign investors comfortable with Indian bonds.

It lowers the risk of future “crisis-driven” taxes.

In simple terms, fiscal discipline today reduces economic pain tomorrow.

2. Agriculture & Rural Economy: Quiet Reforms, Not Loud Announcements

Budget 2026–27 avoids headline-grabbing steps like farm-loan waivers or sharp MSP hikes. Instead, it quietly reinforces a productivity-led rural growth strategy.

Key elements include:

Agri-tech and digital public infrastructure for farmers

Climate-resilient agriculture and productivity enhancement

Expansion of allied activities such as dairy and fisheries

Scaling women-led Self-Help Groups under schemes like Lakhpati Didi

In line with the Budget Speech, the government has strengthened the agricultural ecosystem through the Digital Agriculture Mission, continued support under PM-KISAN, climate-resilient farming initiatives, and enhanced funding for allied sectors including dairy, fisheries, and agri-processing. The scaling of women-led Self-Help Groups further reinforces income diversification in rural India.

Rather than direct income transfers, the government is betting on technology adoption, productivity, and sustainable rural livelihoods. The benefits are structural and long-term, not immediate.

3. The “Middle Class Miss”: What the Budget Didn’t Do

Despite persistent inflation in rent, education, healthcare, and daily expenses, income-tax slabs, major deductions, and the standard deduction remain unchanged.

For salaried households, this translates into lower real disposable income.

The Structural Shift: The New Income Tax Act

While tax slabs remain unchanged, the Finance Minister emphasised the transition to the New Income Tax Act (effective April 2026)—a comprehensive overhaul of India’s decades-old tax framework.

Simplification over deductions: A move away from exemptions like 80C-driven savings toward cleaner taxation.

Ease of compliance: Faster filing, fewer disputes, and reduced litigation.

For taxpayers who heavily used deductions such as 80C and home-loan interest, the new system may feel simpler—but also more expensive.

Fiscal Drag: The Hidden Tax

When salaries rise only to keep pace with inflation while tax slabs remain frozen, more income is taxed at higher rates—a phenomenon known as fiscal drag.

Example:

A salary increase from ₹15 lakh to ₹16.5 lakh may look positive on paper, but much of the increment gets taxed, while real purchasing power barely improves.

Stagnant Deductions and Benefits

Key middle-class pain points remain unaddressed:

Section 80C: Still capped at ₹1.5 lakh, unchanged since 2014.

HRA vs reality: Rents in metros have surged, but HRA rules remain unchanged.

Standard deduction: Continues at ₹75,000 under the new regime.

The message is clear: the government prefers macro-stability over short-term tax relief.

4. MSMEs & Small Businesses: Credit Relief Without Tax Relief

MSMEs continue to receive support through:

Expanded credit-guarantee schemes

Better access to working capital

Technology upgradation and formalisation incentives

However, there is no direct tax relief. The strategy mirrors the broader budget philosophy: strengthen balance sheets and productivity first, let profitability follow.

A notable, though understated, element of the MSME strategy is the renewed focus on export enablement and global value-chain integration. Budget 2026–27 reinforces credit support, technology adoption, and formalisation to help MSMEs scale beyond domestic markets. Improved logistics infrastructure, simplified compliance, and access to export financing are expected to position Indian MSMEs as competitive participants in global supply chains.

5. Health & Education: Capacity Expansion, Not Cost Relief

Budget 2026–27 supports:

Expansion of medical colleges and healthcare capacity

Digital health infrastructure

Skill-linked education and training

The Budget continues to prioritise capacity expansion through higher allocations for healthcare and education infrastructure. While this strengthens long-term service availability, it does not immediately ease out-of-pocket expenses for middle-class families.

6. Sector-Wise Deep Dive: Who Won, Who Lost

Real Estate & Housing

Affordable housing gets a push

No change in the ₹2 lakh home-loan interest cap

Metro homebuyers see limited relief

Automobiles & EVs

Policy focus shifts to electric buses and two-wheelers

Commercial EVs benefit more than premium cars

Defense & Manufacturing

Defense allocation crosses ₹6.5 lakh crore

Strong push for domestic procurement and deep-tech

Technology, Semiconductors & R&D

Semiconductor Mission 2.0

₹1 lakh crore private-sector R&D corpus

7. Wallet Watch: Customs Duty and Cost of Living

What may get cheaper:

Smartphone components

Life-saving medicines

Gold and silver (calibrated duty cuts)

What may get costlier:

Selected plastic products

Certain specialised chemicals

The immediate household impact is limited, but sectoral business impact is meaningful.

8. Inflation Strategy: Control Supply, Not Subsidies Demand

The government’s stance is clear: inflation control will come through supply-side efficiency, infrastructure expansion, and fiscal discipline—not through tax cuts or subsidies.

9. Digital Governance & Ease of Living

Budget 2026–27 continues India’s push toward:

Simplified tax compliance

Reduced litigation

Predictable, digital governance

These measures may not raise income directly, but they reduce hidden costs and uncertainty.

10. Youth, Skills and First Jobs: The “Yuva Shakti” Focus

The budget places strong emphasis on employability rather than guaranteed jobs:

First-job support linked to EPFO registration

A large internship pipeline with stipends

Industry-linked skilling for AI, digital, and advanced manufacturing

Support for entrepreneurship and the creator economy

For young Indians, the benefit lies in pathways to experience and employability, not one-time freebies.

11. What the Government Chose Not to Do

Just as important as what the budget announces is what it avoids:

No large-scale cash transfers

No consumption-led stimulus

No broad middle-class tax cuts

This is a deliberate policy choice, not an omission.

Vijay Foundations’ Verdict: Great for the Economy, Tough on the Household Budget

Union Budget 2026–27 is a high-quality nation-building budget, but a tough one for middle-class households. It strengthens India’s long-term growth story while asking salaried families to absorb continued fiscal pressure.

For businesses and investors, it inspires confidence.

For households, it demands better planning, disciplined saving, and strategic investing.

What You Can Do This Week

Compare old vs new tax regime for your current CTC.

Increase SIPs or long-term investments by your last salary hike.

Review loans, insurance, and emergency funds (6–9 months).

Frequently Asked Questions (FAQ)

Q1: Why wasn’t the 80C limit increased?

The government appears unwilling to sacrifice revenue while prioritising high capex and fiscal consolidation.

Q2: Will home-loan interest rates fall after this budget?

Not directly, but fiscal discipline may support lower long-term yields if inflation moderates.

Q3: Is the old tax regime being removed?

No. It remains optional, though policy nudges more taxpayers toward the new regime.

Disclaimer:

This article is for informational purposes only and does not constitute financial or investment advice. Please consult a qualified professional before making decisions.

Adv. Mamta Singh Shukla

Adv. Mamta Singh Shukla

Supreme Court of India | Certified PoSH Trainer

Finally, the article was originally published by Vijay Foundation. For more legal and public-interest articles, readers may visit vijayfoundations.com.