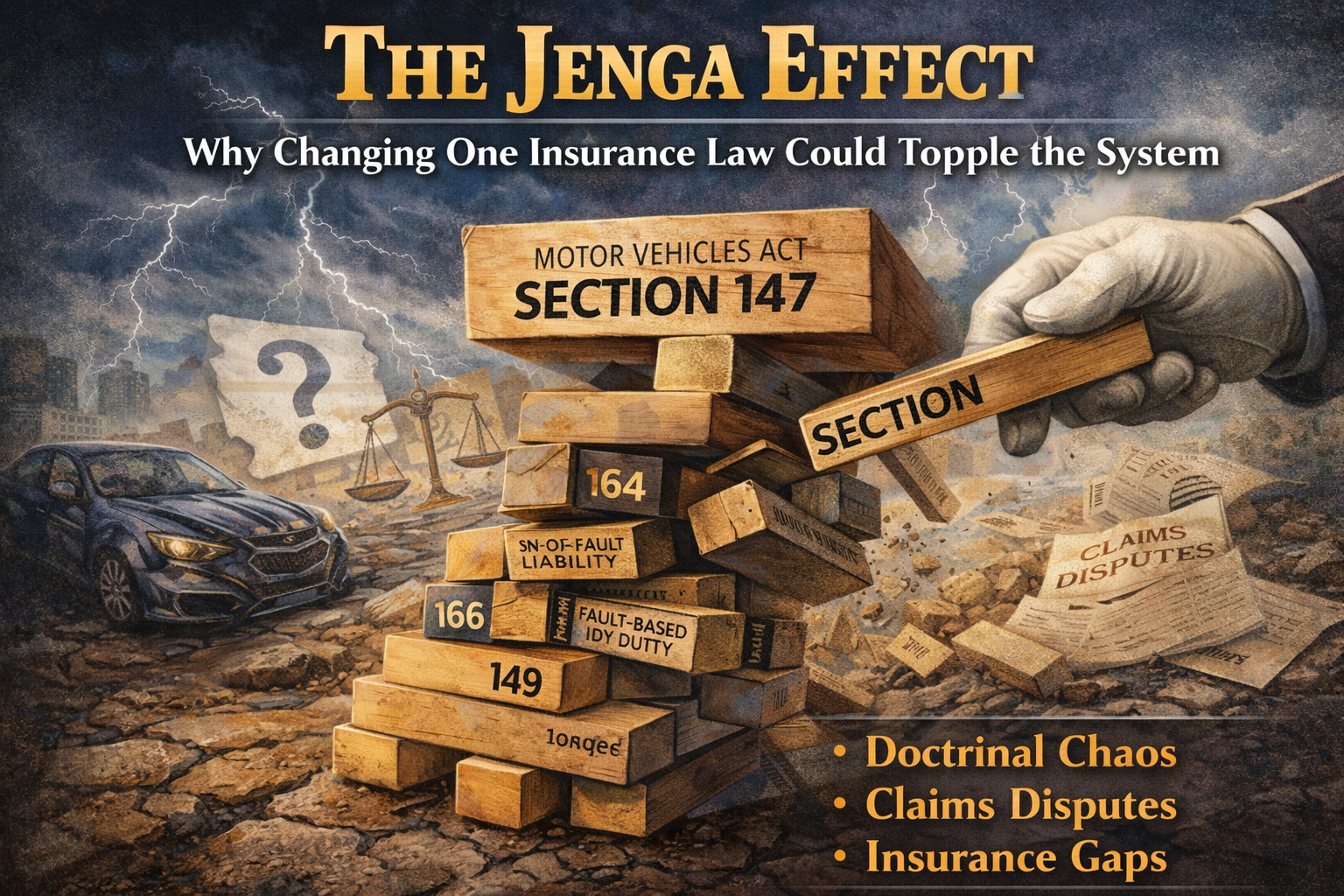

The Jenga Effect: Why Changing One Insurance Law Could Topple the System

Legal reform is a lot like Jenga. You cannot simply pull out one block and expect the tower to stand firm; you have to consider how the weight is distributed.

This is the precise warning echoing through legal circles regarding potential amendments to the Motor Vehicles Act. A recent critique, titled “The Fault in Our Statutes,” argues that if Parliament amends Section 147 in isolation, it risks triggering “doctrinal turbulence and procedural chaos.”

Here is why this specific legal tweak could cause a major trip-up for India’s insurance framework.

The Core Problem: The “Gravitational Pull” of Section 147

Section 147 is the heart of motor vehicle insurance—it mandates the requirement of policies and, crucially, sets the limits of liability. Currently, for third-party injury or death, the liability is generally unlimited.

However, there is talk of amending this section, perhaps to introduce caps or change the scope of mandatory coverage. The problem is not the change itself, but the method. As the article points out, Section 147 does not exist in a vacuum; it exerts a “gravitational pull” on other vital sections of the Act.

If you change the “limit” in Section 147 without adjusting the “process” in the other sections, the math stops working.

The Domino Effect: Sections 164, 166, and 149

To understand the chaos, we have to look at the three other players in this game:

- Section 164 (No-Fault Liability): This allows victims to claim a fixed sum without proving who was at fault. It is fast, but the payout is capped.

- Section 166 (Fault-Based Liability): This is the traditional route where victims prove negligence to get higher, often unlimited, compensation.

- Section 149: This section outlines the insurer’s duty to satisfy judgments and settle claims.

Here is the “Doctrinal Turbulence”: Imagine Parliament amends Section 147 to cap the insurer’s liability. But, it leaves Section 166 untouched, which allows courts to award unlimited damages based on the victim’s loss (income, age, dependents).

Suddenly, a gap opens up. If a Court awards ₹50 Lakhs under Section 166, but the new Section 147 says the insurer is only liable for ₹10 Lakhs—who pays the remaining ₹40 Lakhs? The driver? The owner? Or does the victim go empty-handed?

Consequently, we end up with “procedural chaos.” Courts will be clogged with disputes over who is responsible for the balance amount, defeating the very purpose of insurance: quick and assured relief for victims.

The Solution: A Holistic Approach

The critique rightly suggests that reform must “learn to walk without tripping.”

You cannot modernize Section 147 while leaving Sections 164, 166, and 149 in the past. Instead, Parliament must view these sections as a single, interconnected ecosystem. Any change to the limit of liability must be accompanied by a clear roadmap for how claims are processed and who pays the bill.

In conclusion, streamlining motor vehicle laws is necessary, but piecemeal amendments are a trap. Ultimately, we need a reform that balances the financial health of insurance companies with the fundamental right of road accident victims to receive fair compensation.

Sources & Links

The fault in our statutes: Motor vehicle insurance reform must learn to walk without tripping – Bar & Bench (critique on reform risks) Bar & Bench column on insurance reform critique

Motor Vehicle Act Sections & insurance basics – Drishti Judiciary overview of third-party insurance and related sections (Sections 145–164 etc.) DrishtiJudiciary – Third Party Insurance provisions

Motor Vehicle Act Section 166 explained – Drishti Judiciary explanation of fault-based compensation mechanism DrishtiJudiciary – Section 166 overview

Insurance duty and pay-and-recover principle case – Allahabad High Court holding on insurer’s duty under amended Act LiveLaw on insurer liabilities under MV Act amendments

Adv. Mamta Singh Shukla

Adv. Mamta Singh Shukla

Supreme Court of India | PoSH Trainer

Finally, the article was originally published by Vijay Foundation. For more legal and public-interest articles, readers may visit vijayfoundations.com.

Support Vijay Foundation

If you value independent analysis and public-interest work on technology and privacy, consider supporting our mission.